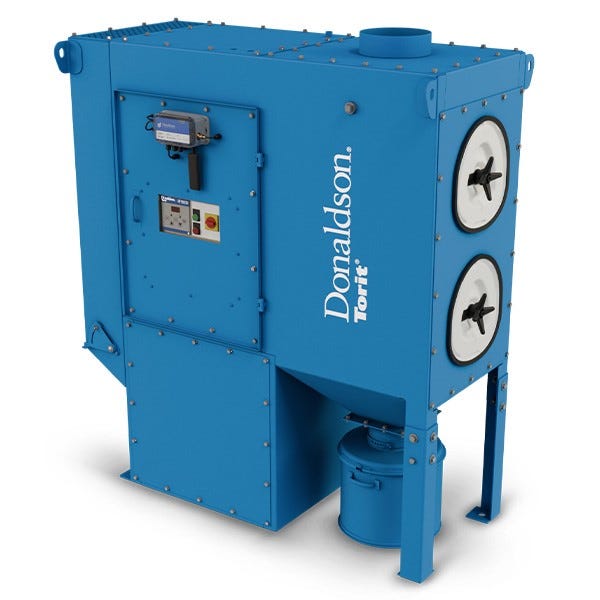

Dust Collection

Q&A: Exploring Static Pressure in Dust Collection Systems

Dust Collection

Q&A: Exploring Static Pressure in Dust Collection SystemsQ&A: Exploring Static Pressure in Dust Collection Systems

This Q&A is from the 2024 DryPro Webinar with the same title.

Sign up for the Powder & Bulk Solids Weekly newsletter.